Indirect ownerships are those in which land is owned by a legal entity rather than by a person.

INDIRECT OWNERSHIP

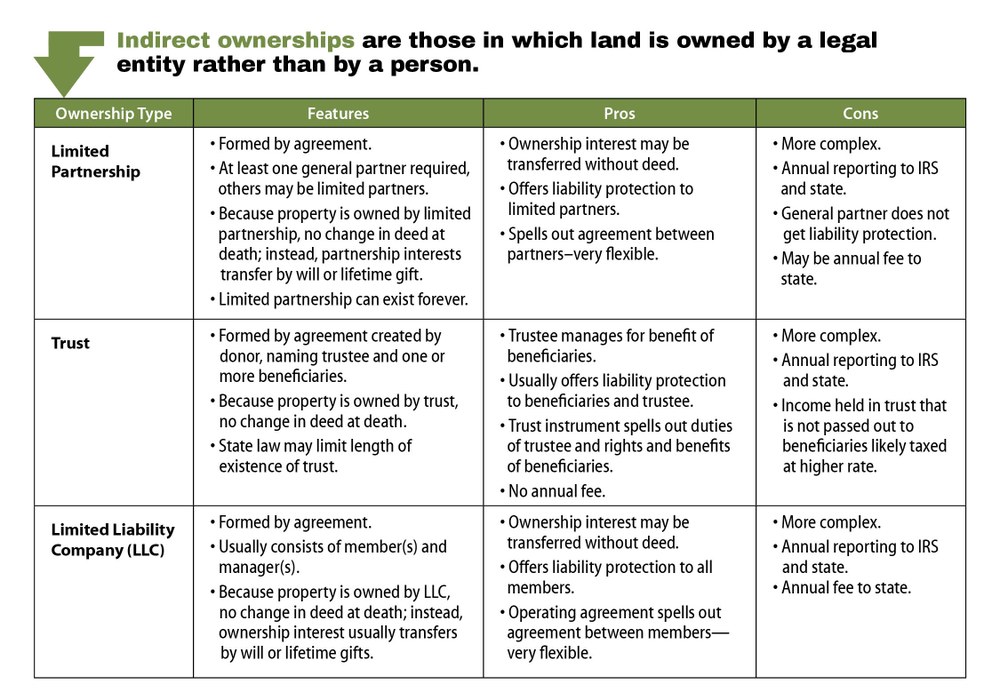

Indirect ownerships are those in which land is owned by a legal entity rather than by a person.

Indirect ownerships can be more complex to set up, but they do bring with them opportunities to protect individuals from liability, as well as the ability to gradually change or transfer the ownership, which can offer important tax benefits. Following is a list of some of the most common indirect forms of land ownership that families can use to achieve their goals:

- Limited partnership. A limited partnership is an organized entity for which income and loss go on the owners' personal tax returns. Taxes and accounting for limited partnerships are relatively simple, but they do require annual reporting to the IRS. Ownership is transferred by interest instead of through a deed, but when one partner dies, the partnership usually terminates unless the remaining partner(s) agree to maintain it.

- Trust. There are many kinds of trusts and reasons for setting them up. In general, trusts operate in a top-down fashion in which the creator, usually the landowner, names a trustee, who manages the assets and must act as directed and in the best interests of the trust's beneficiaries. The beneficiaries are those named in the trust who will be receiving assets from or otherwise benefit from the trust. The way in which the land will be transferred, the timing of the transfer, and how decisions will be made about the land can be written into the trust. Other common reasons for creating a trust include avoiding the cost and delays of probate, assigning a trustee to run your affairs if you are unable to do so, reducing or eliminating estate taxes, and keeping your estate private.

Some states limit the number of years that a trust can stay viable, so while trusts can offer a good option for families, they are not a permanent solution. The trustee has a responsibility to protect the financial value of the assets in the trust, which may make it difficult to permanently conserve land in a trust, since permanent conservation naturally reduces the value of the land. If permanent land conservation is a goal now or in the future, landowners should include that goal as part of the organizing principle of the trust.

- Limited liability company (LLC). When choosing to use an LLC, land ownership is transferred to the LLC, and the rules that run it are put into an operating agreement and agreed to by all initial members. The LLC is governed by a manager for the benefit of all members. Shares of ownership can be transferred between members by gift or by sale, as determined in the operating agreement. The LLC can be used to gradually move ownership from one person to another or between generations. This gradual transfer of ownership can help minimize taxes and provides a mechanism for accommodating the changing needs and life circumstances of members. As the name suggests, limited liability companies protect all owners from liability. Unlike trusts, LLCs can be maintained in perpetuity and amended by members over time, providing a long-term strategy for land ownership and decision making. In addition, land owned as an LLC can be put into permanent conservation. It should be noted, however, that there is an annual cost for maintaining an LLC.

James C. Finley Center for Private Forests

Address

416 Forest Resources BuildingUniversity Park, PA 16802

- Email PrivateForests@psu.edu

- Office 814-863-0401

- Fax 814-865-6275

James C. Finley Center for Private Forests

Address

416 Forest Resources BuildingUniversity Park, PA 16802

- Email PrivateForests@psu.edu

- Office 814-863-0401

- Fax 814-865-6275